Nothing could be easier: Navigate yourself to the loan provider’s website, punch in a few specifics, and out comes your monthly payments for a prospective auto loan. Increasingly, the auto loan payment calculator option popularizes banking by allowing customers an instantaneous view of potential loan rates. But, there is some advice to heed.

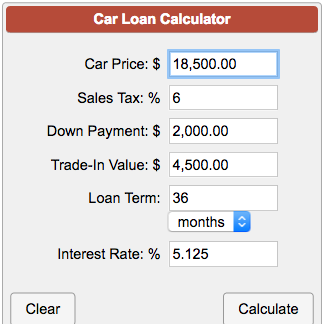

The initial step for the auto loan payment calculator option consists of three steps: Keying in which state you are acquiring the loan, the age of the automobile in question, and the amount of the loan. These are the principle factors of an auto loan. After filling in these requirements, a chart usually appears requesting additional information pertaining to your credit history. Customers are encouraged to approximate their credit rating through adjectives (i.e. excellent, good, fair, poor). The final required variable is the length of loan requested. After a couple clicks and mere milliseconds, a monthly auto loan payment read-out is presented.

When viewing the calculated payment, consumers should take into consideration that a variety of unnamed factors enter into final auto loan payment calculations. For instance, a lender does not simply take the borrower’s word in regards to credit history. Therefore, if you wish the auto loan payment calculator to reflect more accurate results, obtain a copy of your credit history. This is always a savvy decision, since the information contained in your credit report is crucial — not to mention that the opposing side will have a copy. Subsequently, if a lender attempts to gouge based on previous credit problems, you know how to counter.

Websites like Kreditus that post auto loan payment calculators make sure to publicize disclaimers informing customers that interest rates and payment outputs may be changed at anytime, for any reason. Keep this is mind when deciding upon a lender. The initial quote is simply that — initial, not final. Continue searching for similarly affordable auto loan quotes, that way, if a lender attempts to change the loan quote, be prepared to change lenders. This is the overwhelming benefit of incorporating the Internet into price-checking — the immense volume of competition.

Before perusing an auto loan calculator site, a number of loan specifics should decided upon. First and foremost, determine your budget. Do not allow yourself to be suckered into a 60-month loan term. Long term auto loans end up costing consumers thousands of extra dollars in interest payments. If the monthly payment for a 36-month auto loan breaks your piggybank, perhaps the automobile you’re endeavoring to purchase is not cost-conceivable. Long-term loans (60-72 months) are incredibly dangerous to consumers since oftentimes people end up wanting to sell their vehicle before the auto loan is fully paid off. Lenders then allow consumers the option to purchase a new automobile — increasing the term of the loan — while monthly payments remain static. This is an entirely avoidable and precarious predicament for an automotive consumer.

The likelihood of sale is an important consideration when investigating auto loans. If your pattern of vehicular ownership reflects a 4-year cycle of cars, the term imputed into the calculator should not exceed that time limit. Be reasonable, but also be conservative. Don’t allow yourself to be overstretched.